Healthcare spending: The widening gap between cost and capabilities

Healthcare expenditure escalates globally at rates dramatically exceeding GDP growth, creating an unsustainable affordability crisis that demands urgent technological transformation and innovative financing solutions, according to Penny Pinnock from Siemens Financial Services, who examines new analysis of eight-year spending trends across international health systems.

Penny Pinnock

A new Siemens Financial Services (SFS) analysis shows that medical costs are rising faster than Gross Domestic Product (GDP) – demonstrating that the cost of healthcare is escalating beyond the means to pay for treatment and care. In response, new tech-driven approaches aim to boost efficiency and reduce demand through prevention and early diagnosis. Given high costs and budget constraints, specialist finance is increasingly used to make technology acquisition more accessible.

Current models of healthcare delivery are increasingly considered ‘not fit for the future’. As the Director General for Health and Food Safety at the European Commission put it: “The time is ticking on climate, the time is ticking on demographics, and on sustainability in economic terms. We are talking about very sophisticated [health] systems … now we need to somehow make them sustainable[i].”

Different factors affect different healthcare systems across the globe: subsidized healthcare for low-income citizens; rising drug spending[ii]; expensive new treatments, such as biologics and gene therapies[iii]; workforce shortages[iv]; declining trust in state provision[v]; lagging reimbursement rates [vi]; lingering COVID expenses [vii]; soaring out of pocket medical rates[viii]; and cyber threats[ix].

Simultaneously, healthcare spending is accelerating worldwide due to aging populations, more chronic conditions, medical and technology advancements, staff shortages, regulatory and sustainability requirements, rising energy costs, inflation and expanded insurance coverage[x].The cumulative legacy of those factors has to be managed urgently. Everywhere, health professionals are seeking to harness new ways of working and modern technologies to deliver better patient outcomes at lower cost. Current practices are unsustainable and create pressure for healthcare delivery models to change.

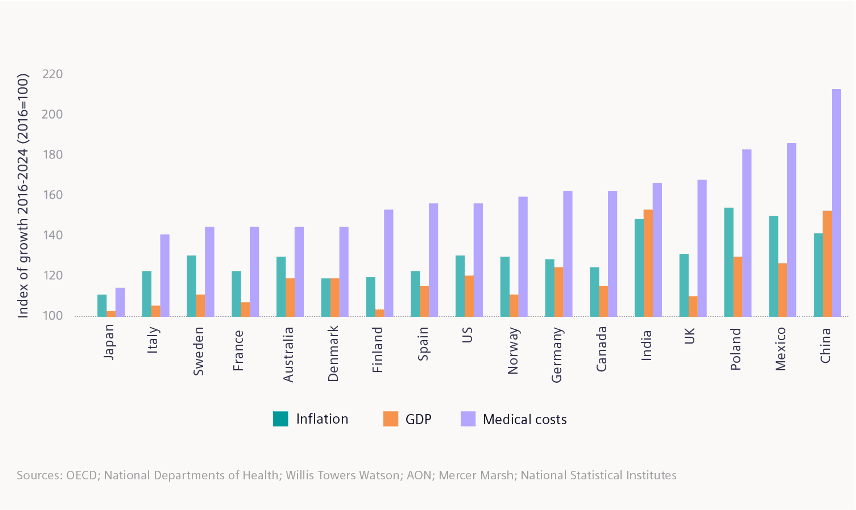

To illustrate the growing gap between the cost of healthcare and available financial resources, Siemens Financial Services (SFS) conducted an analysis of the gap between costs and capabilities. The graph below illustrates that throughout the world, healthcare delivery costs have grown over the last eight years, significantly in excess of the development of Gross Domestic Product. In addition, the pace of this cost growth has accelerated considerably beyond inflation.

The stark conclusion is that healthcare services are becoming increasingly unaffordable for nations globally, the affordability gap is widening, and reform is urgently required.

To illustrate the widening gap between healthcare costs and healthcare resources, Siemens Financial Services (SFS) created an index of healthcare spending to compare with indices of inflation and GDP. GDP is an indicator of resources available for healthcare spending, whether for state/ taxation-derived healthcare systems or those structured on health insurance policies. Index comparisons cover the eight-year period 2016-2024.

Sources: OECD; National Departments of Health; Willis Towers Watson; AON; Mercer Marsh; National Statistical Institutes

Technology for reform

Technology is widely seen as key to healthcare reform. As McKinsey notes, Digital and AI investments provide health systems with opportunities to address the many challenges they face[xi].

Transformative technology fits into two main categories. On the one hand, there is medtech itself, where the digitalization of medical equipment enables, for instance, joined-up patient record access and management, and remote consultation.

On the other hand, there is the rise of ‘smart hospitals’, which are making a radically positive contribution to the effective delivery of healthcare. Hospital workflows are optimised to deploy clinicians and care staff more effectively. Waste is eliminated from in-house pharmacies. Patient flows are made both more efficient and more effective. Recovery periods are shortened through better patient environmental management. And at the same time, energy consumption and costs can be minimised through sensor-based smart building management.

Nevertheless, conversion and transformation come at a price. Which is where the power of financial services comes into play. Healthcare systems want as much of their annual budgeting available for immediate patient services. They do not want (and often cannot afford) to tie up or ‘freeze’ funds in the capital cost of acquiring transformative technology, however powerful its business case.

Finance for change

Change requires investment capital. The very technologies that are being installed to increase efficiency and effectiveness in healthcare are also those which form part of the cost of healthcare delivery in the short-term – virtue of their capital cost of acquisition[xii].

If the capital burden of new technology acquisition could be softened, and precious funds not tied up in depreciating equipment, then healthcare systems reform, improvement and efficiency could be achieved more quickly.

Financial efficiency is as important as technological efficiency. If former capital costs can be converted into operating costs (by harnessing third party capital), then healthcare organisations can transform without tying up their financial resources. For instance, cost-saving energy-efficiency can be financed by harnessing future savings in a flexible financing structure. Existing equipment can be upgraded to superior performance standards through retrofit finance. Financing tools are enabling transformation and new ways of working.

Strategic reform

Finally, many authorities are calling for a more strategic approach to technology-based healthcare reform. One example is the World Economic Forum who say: “Many nations invest in healthcare, but most have not presented a cohesive strategy to integrate physical and digital healthcare infrastructure[xiii].”

To take just one example – medical imaging – various commentators are pointing out the strategic benefits of new-generation technologies and re-engineered workflows. A multi-study review in Europe notes: “Direct access to imaging for GPs can have many benefits for healthcare service delivery, patient care, and the wider healthcare ecosystem[xiv].”

Portable and remote medical imaging is gaining much attention from the United States through to Asia, with a variety of studies emphasizing positive impact and improved access[xv], with new sales of some modalities showing Compound Annual Growth Rates (CAGR) in excess of 10%[xvi]. Similarly, a study published by the Journal of the American College of radiology points to the positive impact of Artificial Intelligence (AI) in assisting radiologists in diagnosing diseases more accurately and efficiently[xvii].

As McKinsey concludes: “Successful health systems will invest in areas with the greatest potential impact while removing barriers—for example… by upgrading legacy infrastructure[xviii].”

Enabling investment

As healthcare systems worldwide struggle with rising costs and increased patient demand, the adoption of next-generation technology has become essential – not just to improve patient outcomes, but to drive efficiency, reduce energy use, and ease workforce pressures.

Global authorities – such as the WHO[xix] – have highlighted the increasing need for healthcare financing reform to alleviate the capital investment burden. Others – in the US, Europe, India and China – point to the need to attract private sector finance into their health systems, even when historically largely state-supported[xx].

To accelerate transformation without draining limited budgets, many are turning to specialist financiers with the knowledge to tailor the most suitable financing structure for organisations’ strategic and operational goals.

- Subscribe to the Healthcare Leaders Briefing series by Siemens Financial Services for more discussion on priority investment areas for transformative healthcare, along with the financing techniques that enable this investment: https://www.siemens.com/global/en/products/financing/whitepapers/whitepaper-healthcare-transformation-finance-solutions.html

References

[i] https://healthpolicy-watch.news/europe-struggles-to-keep-health-systems-afloat

[ii] In the U.S., prescription drug spending grew 8.4%, driven by an acceleration in prescription drug prices and increased utilization of retail prescription drugs . China routinely spends nearly 40% of their health expenditure on pharmaceuticals, which is substantially higher than the OECD average of 19%: https://www.ama-assn.org/about/research/trends-health-care-spending; also, Hartman, M., Martin, A., Whittle, L. and Catlin, A. National Health Care Spending In 2022: Growth Similar To Prepandemic Rates. Health Aff (Millwood). 2024 January; 43(1).; https://www.lse.ac.uk/business/consulting/assets/documents/Gilead-Pharmaceutical-Policy-in-China-Final.pdf

[iii] https://www.reuters.com/world/us/us-employers-see-biggest-healthcare-cost-jump-decade-2024-2023-09-20

[iv] https://www.weforum.org/agenda/2024/06/chinas-healthcare-system-smart-green-innovations-sustainable

[v] https://www.ft.com/content/0ef68e30-bbe7-4b6e-8d17-479a552be994

[vi] https://www.aha.org/press-releases/2024-05-02-new-aha-report-hospitals-and-health-systems-continue-face-rising-costs-economic-pressures

[vii] During the COVID-19 emergency, EU countries were granted the flexibility to spend beyond the 3.5% annual budget spending deficit mandated by the bloc, allowing countries with strong and weak healthcare systems alike to spend as they saw fit to respond to the virus.

[viii] https://www.livemint.com/money/personal-finance/medical-inflation-in-india-reaches-alarming-rate-of-14-reveals-report-11700634947658.html; https://timesofindia.indiatimes.com/business/india-business/cost-of-treatment-doubles-in-5-years-as-medical-inflation-bites/articleshow/102961777.cms

[ix] Ibid; https://www2.deloitte.com/us/en/insights/industry/health-care/future-of-healthcare-in-europe.html

[x] https://www.kff.org/health-policy-101-international-comparison-of-health-systems/

[xi] https://www.mckinsey.com/industries/healthcare/our-insights/digital-transformation-health-systems-investment-priorities

[xii] https://www.hsph.harvard.edu/news/hsph-in-the-news/understanding-why-health-care-costs-in-the-u-s-are-so-high/

[xiii] https://www.weforum.org/agenda/2023/01/healthcare-digital-transformation-infrastructure-davos23/

[xiv] https://www.ncbi.nlm.nih.gov/pmc/articles/PMC10004541/

[xv] Such as: https://www.ncbi.nlm.nih.gov/pmc/articles/PMC10884973/ https://www.ncbi.nlm.nih.gov/pmc/articles/PMC10576557/; https://www.sciencedirect.com/science/article/pii/S1078817423002481; https://www.ncbi.nlm.nih.gov › articles › PMC11217950

[xvi] https://www.rootsanalysis.com/reports/handheld-x-ray-imaging-devices-market.html; https://www.marketresearchintellect.com/download-sample/?rid=1063992

[xvii] https://pubmed.ncbi.nlm.nih.gov/31974390/

[xviii] https://www.mckinsey.com/industries/healthcare/our-insights/digital-transformation-health-systems-investment-priorities